Specialized Tax Strategies

Tax-saving benefits delivered straight to your CFO/CPA

Our Strategies:

Real Estate Deductions

R&D - Innovation Credits

Capital Gain Deferral

Unlock high-impact tax incentives that drive cash flow and long-term growth. Our experts integrate directly with your existing CPA or in-house team to deliver audit-ready strategies without disrupting your existing workflow.

Don’t let taxes be your largest line item.

The BAY Difference

Since 2017, BAY has identified over $1 billion in allowable deductions and tax credits, utilizing advanced R&D credit methodologies, real estate tax strategies, and timely execution of pandemic-era tax provisions as legislation is enacted.

Our CPAs and tax attorneys focus on the complex areas of the tax code most firms don’t have the time or specialization to explore. This depth of expertise places us at the forefront of the One Big Beautiful Bill—interpreting and applying its incentives years ahead of traditional practices.

While most firms wait years for court rulings before taking a position, we apply new rules immediately, delivering audit-ready results backed by full legal defense. Our complimentary reviews in fixed assets and innovation credits routinely uncover material amounts left on the table - often in the six- and seven-figure range.

When it comes to R&D and real-estate-driven incentives, BAY finds what others miss.

Get your deductions the BAY way

At BAY, your success is our priority, which is why we only engage if we can project a significant return on our services.

First, we will provide a complimentary initial consultation to discuss your business operations and financial objectives.

Second, we will propose customized accounting and financial services tailored to your specific needs.

If it makes sense to proceed together, we sign an engagement letter, set the scope, and get to work!

Our Services

Business - Credits and Deductions

R&D - Innovation Credits

A credit that returns a percentage of your innovation spending back to you.

Did you recently invest in new development, process improvements, prototypes, or innovation within your business? If so, you may qualify to claim 8–10% of those annual expenses as a dollar-for-dollar tax credit. Qualified research expenses often include employee time spent on development work and contracted R&D support—putting real cash back into your business.

ERC Denied Claim Advocacy

If your ERC was denied, we evaluate and defend your claim.

If the IRS denied your Employee Retention Credit, we step in to review, reconstruct, and advocate for your eligibility. Whether your business experienced negative COVID impacts, supply-chain issues, operational disruptions, or if the IRS miscalculated your claim, you may still qualify. With a quick 15-minute consultation, our CPAs can determine whether your claim can be successfully defended and resubmitted.

Business or Asset Exit Strategy

A strategy to defer capital gains when selling your business or major assets.

When you're preparing to sell a business, real estate, or a significant asset, we structure your exit through a specialized vehicle—similar to an installment sale—that allows you to defer capital gains and preserve liquidity. This strategy enables you to spread the tax impact over time, retain more of your proceeds upfront, and reinvest with far greater flexibility.

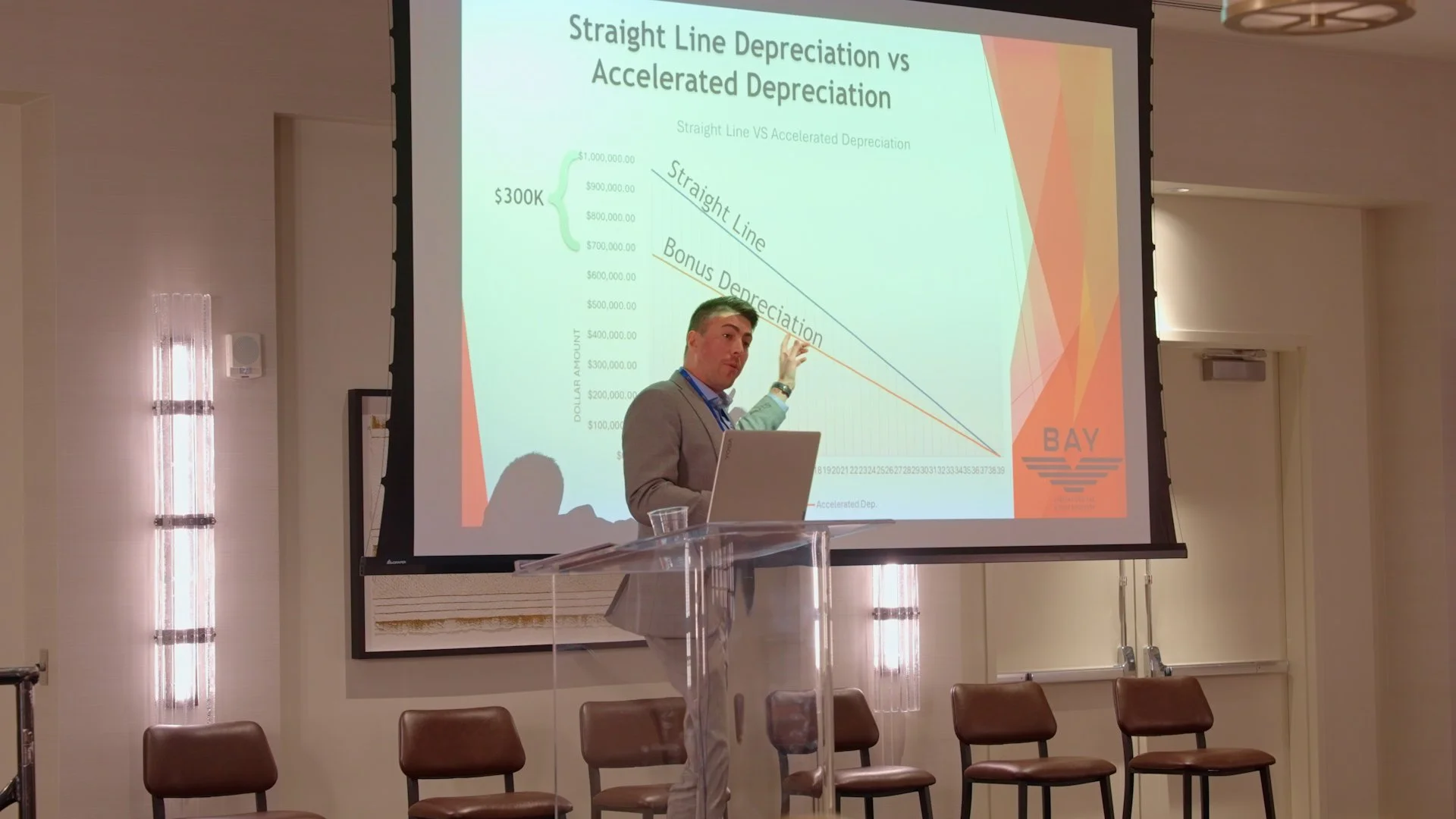

Real Estate - Fixed Asset Management & Bonus Depreciation

Cost Seg Study

A method to speed up depreciation so you get large tax deductions sooner.

Purchased a rental property, commercial building, or signed a triple-net lease? A cost segregation study accelerates depreciation by identifying and separating interior components and land improvements from the building itself—allowing you to take significant first-year deductions through the 100% bonus depreciation granted in the Big Beautiful Bill, and boost cash flow immediately.

Disposition Study

A way to claim tax value on assets you remove, replace, or demolish.

When you remodel, replace equipment, or remove building components, the assets you discard still hold tax value. We identify and claim the remaining depreciation on those retired assets—so you avoid unnecessary depreciation recapture and convert those write-offs into immediate savings you can reinvest back into your business.

CapEx Study

Ensuring your renovations and equipment purchases are classified for maximum tax benefit.

When you invest in renovations, equipment, machinery, or other long-term assets, those costs can generate significant tax benefits. We analyze and classify your capital improvements to ensure every eligible expense is depreciated or deducted in the most advantageous way—reducing your tax liability and improving cash flow over time.

Lookback Studies

All three studies can be completed for properties you purchased this tax year, or ANY previous tax year! We regularly review full portfolios and unlock significant benefts from multiple previous years

Hear what our clients have to say

5 star average review on Google

“Partnering with BAY on the ERC and R&D Tax Credits has been a game changer. Brian’s mastery of these niche areas, combined with his dedication to detail, has truly optimized our tax strategy. The team’s guidance and expertise have not only ensured compliance but also maximized returns. He’s more than a tax expert; he’s a strategic ally in financial success. I highly recommend his specialized services”

-Sarah D.

“Brian, Jason and the team at BAY Tax are nothing short of a collection of wizards when it comes to understanding and helping your company navigate the complicated world of corporate taxes, tax refunds and more. Their work with Discount Forklift on the ERC Credit, R&D program and more have made a huge impact and given us the opportunity to reinvest our money in the company instead of throwing it down the never-ending hole of "business taxes". These guys are the real deal - contact them today!”

- Discount Forklift.

“The BAY team is top-notch in their industry. If you want to save money in taxes through Cost Segregation on your investment properties, you need to hire Brian — He is the best.”

- Mark N.

“Amazing firm, service, and people - I met with Brian a five years ago and we’ve been working on all my projects since. Couldn’t find better anywhere would definitely recommend BAY to everyone!”

- Tom A.

“I had no idea what cost segregation was! So excited to share this new information with my clients.”

- Samantha S.

Contact us

Fill out this form to pair up with one of our expert tax advisors today.

Don’t let taxes be your largest line item!

Follow us on social media to stay up to date on exciting developments in tax strategy!