One Big Beautiful Bill Updates

The new tax bill is full of new tax benefits for real estate investors and businesses. Check out the updates below!

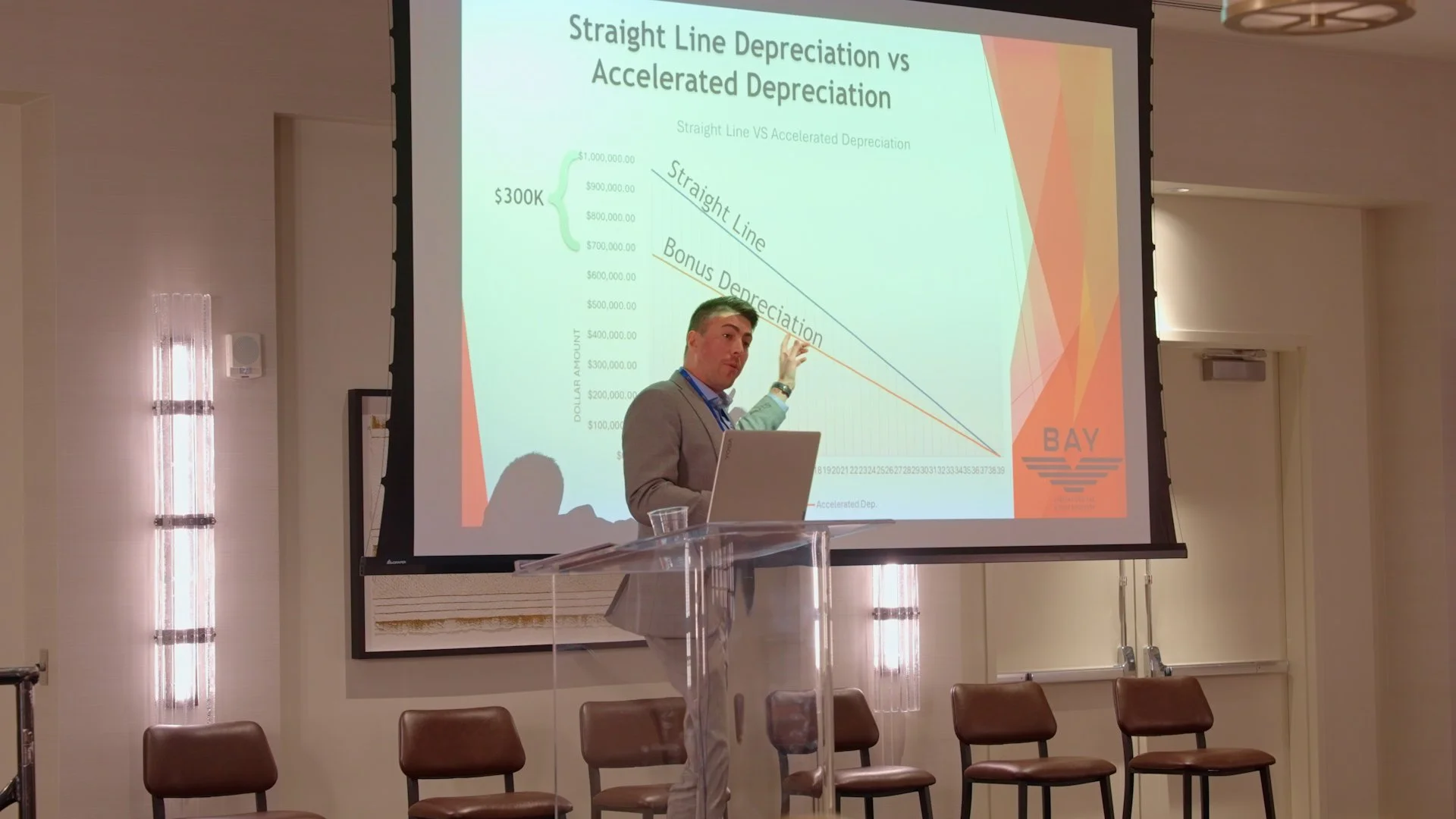

Under the One Big Beautiful Bill, 100% Bonus Depreciation is BACK!

What does this mean for your real estate investments?

For residential rentals or commercial properties acquired after February 1, 2025, you can now take all interior elements and landscaping as a full first year write off using a cost segregation study! Depending on the land value, this can be anywhere from 20%-35% of the total purchase price!

Not all cost segregation studies are created equal. The tax code contains important and specific distinctions between passive and non-passive income and deductions. Our team ensures that the deductions we find using a cost seg study can actually be utilized against your income. Once our work is complete, we typically save clients at least 200% more on their taxes than their previous tax consultants.

No more amortizing research & development expenses!

From 2022 until the passing of the One Big Beautiful Bill, expenses for research and development had to be amortized over a 5-year period in order to receive the Research & Development Credit. This often resulted in businesses ultimately paying more in taxes in order to take the credit.

Now that the OBBB has been signed into law, amortization is gone and businesses can once again take all research and development expenses as a single-year write off and still claim the Research & Development Credit!

Contact us

Fill out this form to pair up with one of our expert tax advisors today.

Don’t let taxes be your largest line item!

Follow us on social media to stay up to date on exciting developments in tax strategy!